Helping small businesses get paid on time

Small and medium-sized businesses in the UK are currently waiting for £26.3 billion in overdue payments (data from BACS). It’s a shocking statistic. Government is taking steps to address this and change the behaviour of late payers, by establishing a Small Business Commissioner – Paul Uppal.

As a small business ourselves, we want to help. So we bid for and won a contract to work in partnership with the Department for Business, Energy and Industrial Strategy (BEIS) to build a digital service for the new Commissioner. The Commissioner’s role will be to provide advice to small businesses chasing late payments and offer a service for making a complaint about a large business.

Turning policy into a service

We’ve been working with the Small Business Payments team at BEIS, a small team of policy experts responsible for implementing the Small Business Commissioner, which was set out in the Enterprise Act of 2016. The team is also responsible for a service for large businesses to report their payment practices and the Prompt Payment Code, an industry-led code of best practice administered by the Chartered Institute of Credit Management.

Delivering a service for the Small Business Commissioner means translating a piece of legislation into a service that meets both users’ needs and policy objectives. We’ve therefore formed a single, multi-disciplinary team with BEIS and have policy experts, design, research, content and product people working closely together. We’re bridging the so-called ‘divide’ between policy and service design by forming relationships with policy, legal teams, subject matter experts and industry bodies to deliver the service together.

We truly believe that working in the open helps. Our fortnightly show and tells are open to anyone who wants to join, and we send regular week notes to keep everyone informed of our progress. We’ve also made the prototype we’re developing open for any BEIS teams, stakeholders and external partners to see.

Where we are now

We’ve just finished our alpha phase, which followed an eight-week discovery. Our discovery research uncovered that many small businesses who haven’t been paid on time don’t know where to go for help or who to contact. The existing service provision is difficult to navigate and most small businesses describe it as a “really big learning curve”.

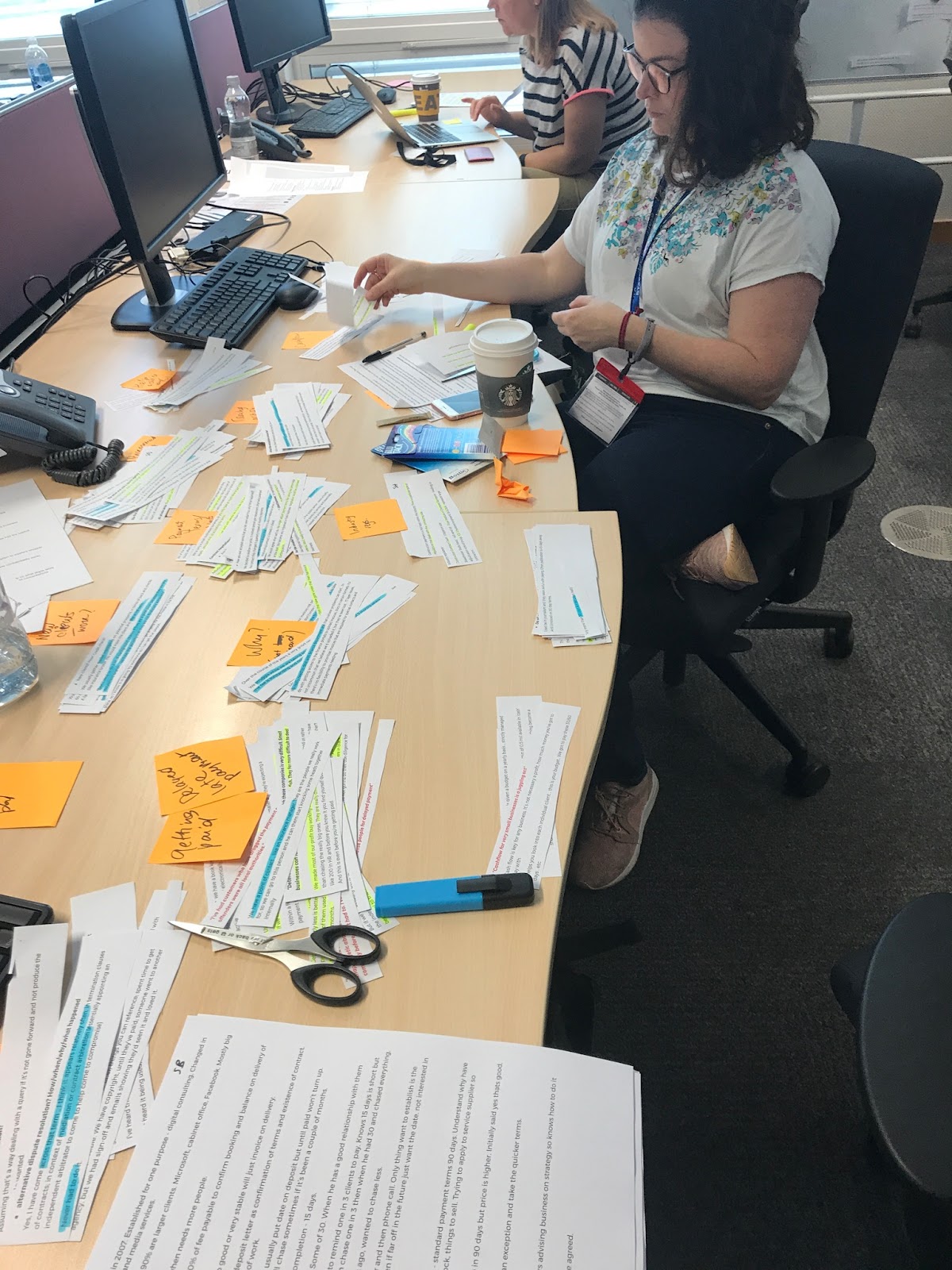

With this in mind, our iterations during alpha have focused on the advice element of the service. It’s really important that the content we write meets users’ needs and helps small businesses resolve their payment issues.

Check, chase, choose

We know that users visiting the Small Business Commissioner website will have a range of business literacy. Users need to be able to quickly understand where they might be in the process of chasing a late payment. Our content is therefore built around three key phases: check, chase, choose.

The ‘check’ section asks small business owners to check that they’ve sent an invoice that is likely to get paid by their client. We’ve provided a list of what information should be on an invoice and best practices.

Many business owners we spoke to felt uncomfortable about chasing large companies for payment as it takes time away from their work and may damage their business relationship. The ‘chase’ section describes how a small business might successfully follow up late payments. It also signposts to rights that are already available to users, such as charging interest.

The last section, ‘choose’, describes the options available to small businesses, including mediation or taking legal action through a service like Money Claims Online. It’s here that we introduce the option of making a complaint to the Small Business Commissioner, which will be available to users later this year.

Simplifying the options available to users

We’re learning more and more about small businesses and their need for trusted, actionable advice. By continuously iterating our prototype and content over our five alpha sprints, we’ve been able to fine-tune the content and design.

Through speaking to subject matter experts, such as legal academics well versed in arbitration and adjudication, we found that some advice or options we originally thought of as helpful were actually unsuitable for small businesses. This has allowed us to reduce the options we’re presenting to users and make them feel less overwhelmed at the prospect of chasing a late payment or escalating further.

We’ll be starting our beta phase soon to build a working version of the website and develop the complaints element of the service. We’ll be continuing to conduct frequent usability testing with small businesses so if you know anyone who would be happy to participate, please contact our team at research@dxw.com.